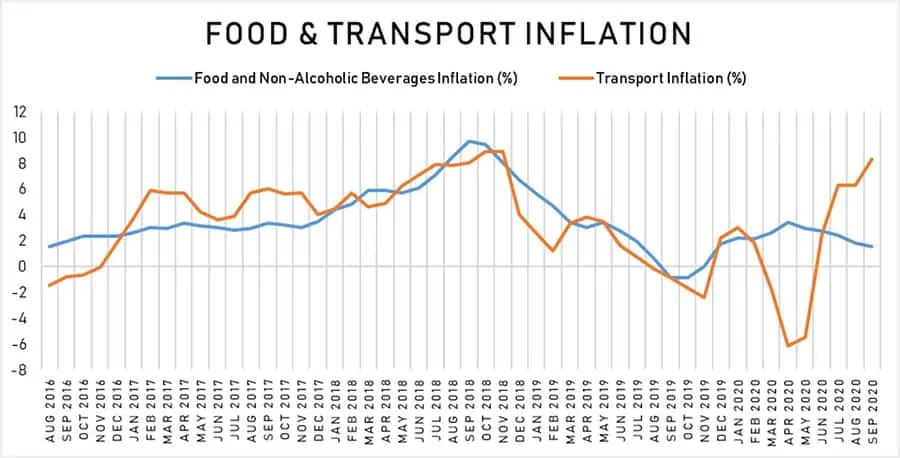

Do you have any idea about how expensive commuting is these days? If not, then let me tell you that it can get pretty pricey. When you think about the amount of time spent traveling from point A to B, you should also consider how much gas costs. Gas prices tend to fluctuate frequently and can vary dramatically depending on where you live.

In addition to gas, other things such as tolls, parking fees, and insurance add on to the total cost of driving. And don’t forget about the wear and tear on your vehicle. Each trip adds up to thousands of dollars over the course of a lifetime. On top of that, traffic congestion only makes matters worse.

How much does transportation cost per month in USA? The answer to this question might surprise you.

How Much Are Transportation Costs

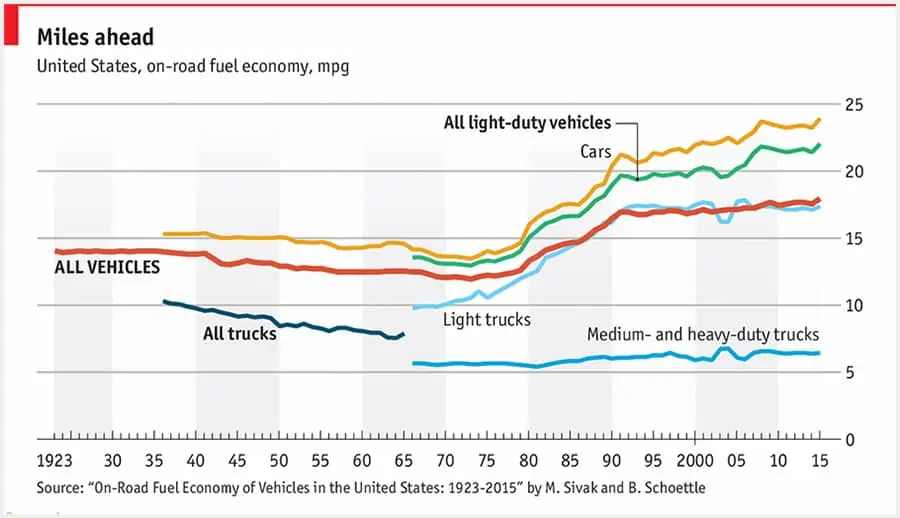

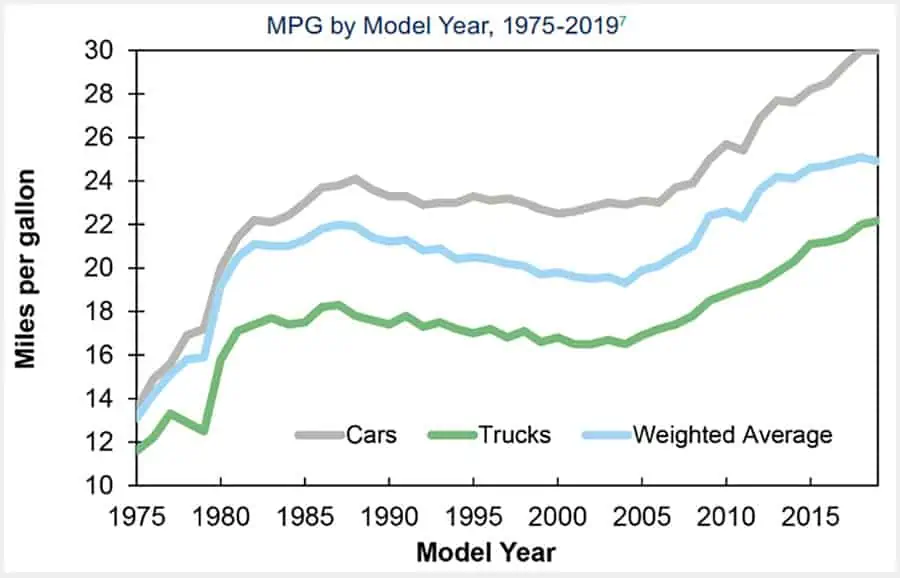

Transportation costs include things such as gasoline, parking fees, tolls, airport expenses, and car maintenance. When calculating how much money you need for a trip, keep in mind that gas mileage depends upon the vehicle. This means that fuel efficiency differs depending upon the model and year of the vehicle. Therefore, when planning out a trip, consider the distance you plan on driving, the number of passengers per car, and the miles/gallons per gallon which you want to achieve.

Daily chart: Donald Trump plans to roll back fuel-economy standards | Climate Change

If you travel at rush hour, expect to pay higher rates. Other factors include the type of road (such as interstate versus city streets), the season (summer versus winter), the location, and the time of day. Another important part of transportation is maintenance and repairs. Even with regular maintenance, vehicles can quickly become obsolete due to technology advances. To ensure that your vehicle will continue to run smoothly throughout its lifespan, conduct an annual inspection.

Also Related:

Why Is Public Transportation So Bad in the US

How Much Does Transportation Cost Per Month for an average person in USA

The average American spends $1,500 per year on transportation. This means that the median household spends $2,200 on car payments, gas, insurance, parking tickets, etc. That’s more than many people spend on food or clothing combined. And if you’re like most Americans, you probably drive everywhere — which could be costing you hundreds of dollars a month.

It’s no wonder why so many people are turning to mass transit as an affordable way to get around. But what exactly is mass transit? It includes everything from subways to buses to ferries to trains. There are even commuter planes and boats! So whether you want to see all of America or just hop on the train in New York City, we’ve got your covered.

Why Is Transportation Expensive

For starters, we can’t deny the fact that oil prices have been skyrocketing. Due to the ever-increasing demand for crude oil, there has been a dramatic spike in oil prices.

Showing oil price per barrel

Oil price spikes as storms gather – MacroBusiness

As less oil is produced, the price goes up. Then there’s maintenance and repair costs. If you’re buying new cars every few years instead of maintaining and repairing them, you’re not only wasting money but contributing to rising oil prices.

According to AAA, approximately 30% of drivers stop to fill their tanks every single week. With all these stops and starts adding onto the overall cost of driving, it’s no wonder how expensive trips ultimately get.

How Much Should I Spend on Transportation a Month

Transport costs vary depending on where you live and how often you go out. If you commute between home and work every day, then the cost of public transport will be roughly $80 per week. However, if you drive everywhere, the cost can be about $300 for gas alone. The best thing to do is research what your options are, and decide which one suits your budget the best.

Personal Transportation Factsheet

If you’re looking for ways to cut back on transportation costs without sacrificing quality of life, you’ll find some helpful tips below:

Take Advantage of Discounts and Deals

Look into taking advantage of different discount programs offered by various companies. Many schools offer discounted bus passes that allow students to take trips within their area. Depending on what kind of school it is, you may also be able to use student ID cards that come either free of charge or for a nominal fee.

Also Related:

What is the Best Home Charger for a Tesla? Buying Guide

Find Alternate Transportation

You don’t have to feel obligated to own a private car if there is another option available. Buses, taxis, shuttles, bicycles, and other forms of alternative modes of transportation exist and they may very well be better options for certain aspects of your life.

Use Public Transit Whenever Possible

Many cities now offer excellent public transportation services that cover almost all major areas within them. With trains, subways, buses, light rail systems, and trolleys, getting around town has never been easier. Some public transportation fares are even discounted during peak times, meaning that you can ride all day long and pay less than what it costs to buy gas. Plus, all of these public transportation services accept credit card payment and have automated ticket machines at each station.

Avoid Parking Fees

While driving yourself is not always the most expensive method of getting around, often paying for parking fees is unavoidable whether you’re traveling for business or pleasure. However, parking lots are usually cheaper when purchased in advance instead of when you arrive at your destination. Also, try using one of the many apps that help you find affordable parking lots near important places such as shopping malls, hospitals, airports, universities, sports events, and movie theaters. Not only do these apps save you money, but parking lots are generally cleaner and safer since there are no meters to worry about. Many parking lot owners will even let you park for free every night in exchange for an advertisement on your phone which generates revenue for them.

Sign Up Early and Save Money

Whether you decide to use one of the above mentioned methods of transport or drive by yourself, saving as much money as possible while doing so is ideal. The earlier you book flights, hotels, rental cars, and restaurants, the lower prices you’ll most likely obtain. If you plan ahead, you might even be able to avoid having to spend extra cash on things like tolls, gasoline, and parking costs altogether. It’s easy enough to keep track of upcoming appointments and events via calendar software or apps like Google Calendar. Once you know exactly when and where they are taking place, you can easily adjust travel plans accordingly.

Now that we’ve covered some of the best ways to save money, let’s examine how to calculate your monthly transportation budget.

If you’re currently living paycheck to paycheck, chances are you barely make any money left over at the end of the day. This means that you need to ensure you save as much money as possible throughout the course of your entire month. By making small adjustments in your life, you’ll be able to create more of an emergency fund and put a little away for future financial troubles. For example, if you regularly eat out three nights a week, you could quickly cut down on this expense by going out just twice a month. In addition, consider cutting back on unnecessary expenses to free up even more money.

Also Related:

How Much More Efficient Are Electric Cars?

How to Create a Monthly Transportation Budget

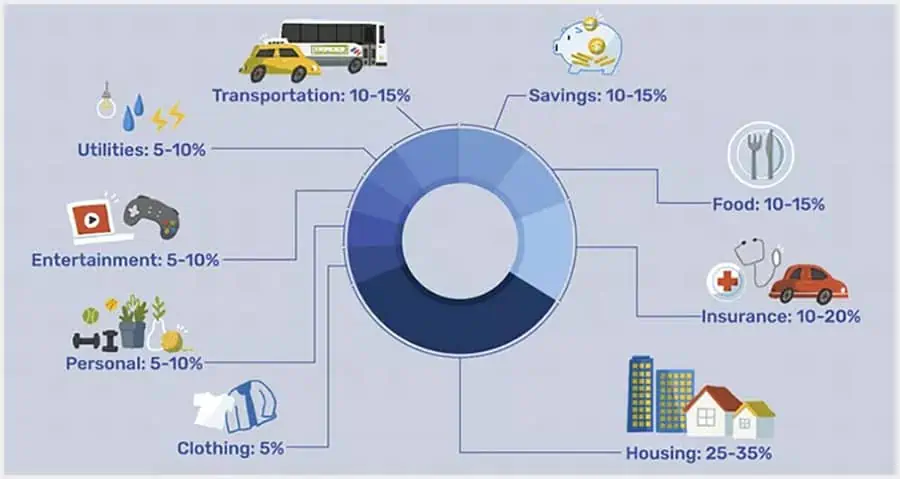

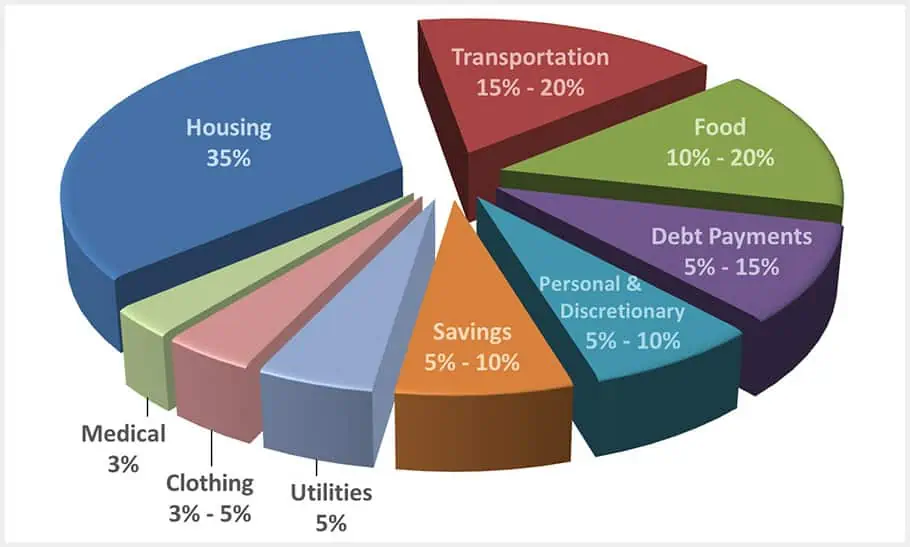

A monthly transportation budget usually includes expenses such as fuel, maintenance, insurance, vehicle wear and tear, parking fees, tolls, parking garage charges, depreciation, and other miscellaneous items. The total amount spent on each category should be recorded and added together to create a total for the month.

How To Figure Out Budget Percentages for Money Goals

Since gas is probably the largest component of your overall monthly transportation budget, it also makes sense to include the average price of gas during your trip. To figure out the average gas price, you first divide the total number of miles driven by 12 (the standard distance travelled from city center to city center). Next, multiply the number of gallons used by the rate displayed on the pump. Finally, add the two numbers together to find what your average gas price per mile looks like.

Once you have determined the average gas price, divide it into the total amount spent on gas for the month to find a percentage figure indicating where you stand compared to the rest of the country. You can then use this information to set targets for reducing the amount of gas you purchase.

For example, if you normally spend $500 per month on gas, but only drive 15,000 miles per year, you would need to reduce your spending by about 10% ($50) to reach your target. Of course, there are many factors that can influence whether or not you actually achieve these goals. However, setting realistic targets will help you stay motivated and focused on your long-term savings efforts.

The following tips can help you determine which areas of your budget require immediate attention:

- Determine Your Total Expenses

- Calculate Average Gas Prices Per Mile

- Set Goals for Reducing Spending

- Track Progress

- Adjust Targets Based On Actual Results

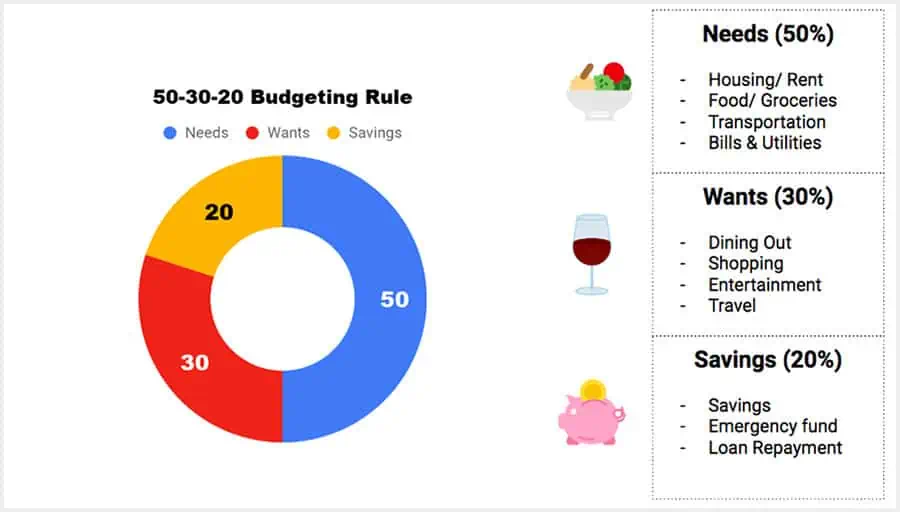

What Is the 50 20 30 Budget Rule

The 50/20/30 budget rule says that you should allot 50% of your income to “needs”, 20% for “wants”, and 30% to savings (or if you want, towards debt repayment). While this may seem very unrealistic, it is actually quite achievable for those who really attempt to stick with it. One way to determine which needs go first is to think of the different types of bills that come due throughout the month: rent, mortgage payments, car payments, utilities, student loan payments, credit card payments, etc.

Understand 50-30-20, a simple budgeting rule

Also Related:

Cars Self-Driving and Where It Can Work? Electric Ride Lab Opinion Featured on Lifewire

Once you have determined what goes first, simply prioritize how necessary each bill is. If you don’t meet all of your obligations, then you’re going to need to make sacrifices elsewhere, but at least you now know exactly what you need to focus on reducing. You should also take into account other factors outside of your control like medical emergencies and unexpected repairs.

As far as saving goes, the easiest way to start would be to open a high-interest savings account and deposit 10 – 15% of your gross pay. These funds should only be used for regular expenditures such as food, clothing, shelter, transportation, healthcare, education, entertainment, hygiene products, recreation, insurance, and incidentals.

Anything else that isn’t considered basic human necessities should not be saved for; you’re better off spending it immediately. Additionally, you will find it extremely difficult to stay within your budget if you fail to include some kind of debt repayment in your overall amount. Your debt consolidation strategy must therefore include setting aside roughly 25% of your monthly income for repaying debts.

You should try to keep your actual budget below 40%. As soon as you exceed this level, you’ll quickly begin feeling the strain of living beyond your means. This doesn’t mean that you should skimp on everything else, however. It just means that you shouldn’t be able to live comfortably while still exceeding your budget limits.

One common mistake people make when deciding upon their budget amounts is basing them solely on the percentage of their income that they devote to debt repayment. To avoid doing so , you should use an envelope system whereby you divide up your money into three separate envelopes. The amount in your envelopes always stays the same size regardless of the total budget. The goal here is to ensure that you don’t feel any financial pressure to lower your expenses or increase your debt repayments because the envelopes are getting larger and larger. Instead, you should only adjust your budget amounts according to either increasing or decreasing costs.

Budgeting Percentage Guidelines for Living Expenses

While using an envelope system is the most efficient way of organizing your finances, there are some drawbacks associated with it. Some people believe that by keeping a tight rein on their budgets, they’re able to save more money because they won’t spend anything extra. However, since this method allows no wiggle room, there’s no buffer in case unforeseen circumstances arise.

If you happen to be one of those people that aren’t comfortable with staying within strict guidelines, feel free to choose another method, but remember that the envelope system works best for those who value discipline over comfort.

A good rule of thumb is to allocate half of your net earnings to paying down credit card balances and the rest towards your debt payments. Make sure that you budget enough money to cover these obligations in full from the beginning. If you have trouble finding a balance between your debt repayments and other discretionary items like groceries or rent then you can always resort to borrowing money at a higher interest rate. You also need to track your spending carefully to prevent yourself from falling into bad habits such as taking out excessive loans without having set adequate funds aside beforehand.

Also Related:

When Will Electric Cars Be Affordable

Conclusion

Transportation costs vary depending on where you live and how often you go out. If you are going to work everyday for example, then you may need to spend $1000 a month on transportation. However, if you only go out once a week or less, then you might be able to save money by driving yourself instead of taking a taxi or bus.

In general though, transportation costs will depend largely on the number of times you travel each month. A trip every day would require more gas than a trip every two weeks. Therefore, if you plan ahead, you should be able to cut back on some of your monthly expenditures. Allocating money to transportation will allow you to do exactly that.

You can start by setting aside some money for transportation in advance. Next time you pay your bills, add all the receipts and invoices together to determine what your final transportation costs really were. This will provide you with a realistic estimate which you’ll be able to compare against future figures.

Remember that transportation costs are calculated differently depending on whether you drive or ride public transport. For instance, if you take the subway everyday to work, your transportation costs will be higher than someone who drives everywhere. Likewise, the price of gasoline isn’t consistent throughout the country. A gallon of gas in San Francisco could cost twice as much as a gallon of the same fuel in Detroit.